The Growth Tools Your Institution Needs, Personal Finance Tools People Will Actually Use

JoyCompass keeps your clients engaged with you—while giving you insights to drive total relationship value.

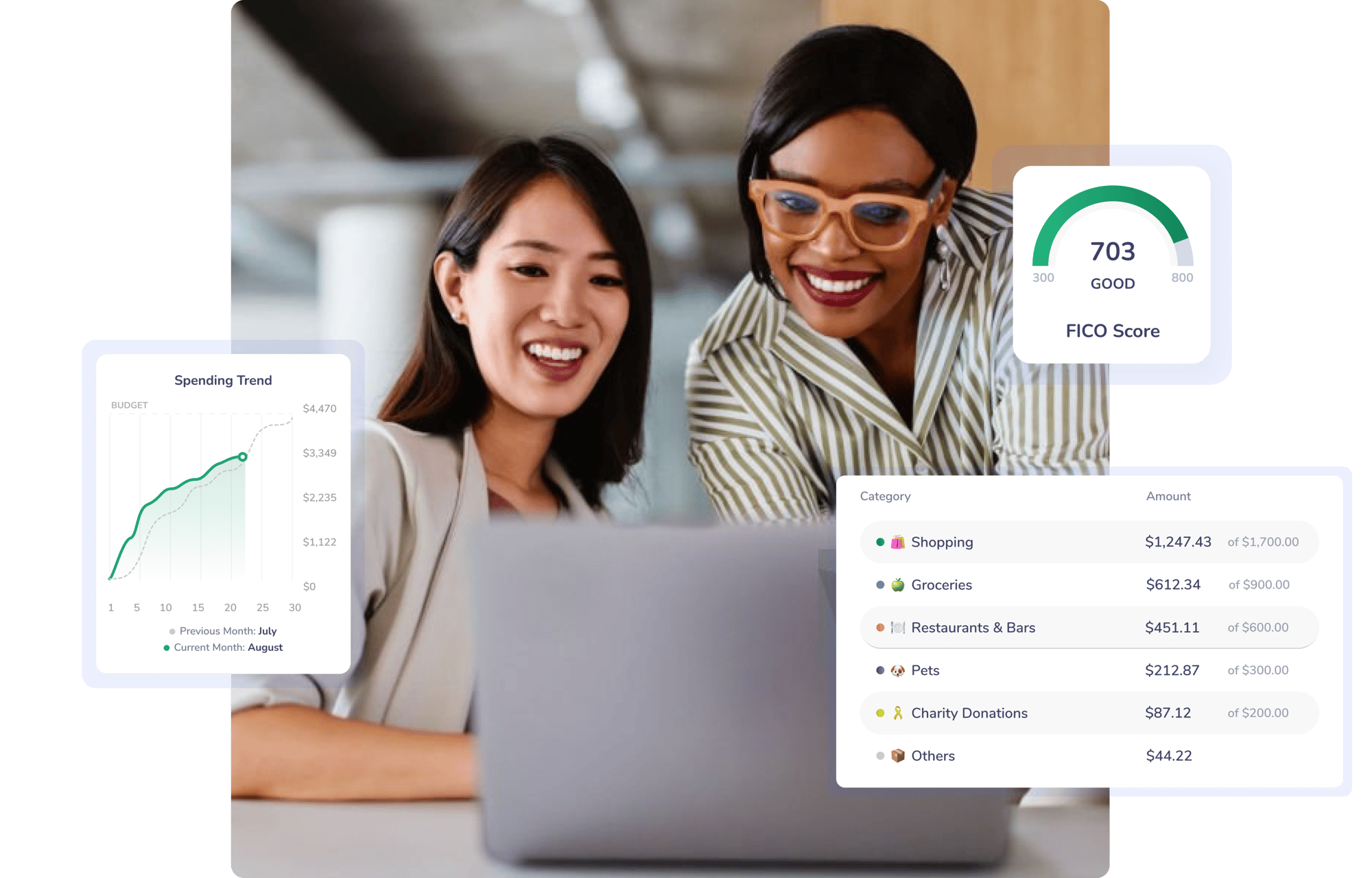

A Financial Empowerment Platform That Promotes Healthy Habits and Long-Term Engagement

Show your community that you’re a long-term financial partner helping them make wise decisions, whether they’re buying a latté or a new house.

Financial Wellness Scoring

Give your community a better way to measure their financial health than credit scores. JoyCompass gives users a true, comprehensive indicator of financial wellness, accounting for earning, saving, spending, debt, and more.

Gamified Personal Finance

JoyCompass takes the intimidation factor out of personal finance by breaking it down into personalized, bite-sized, challenges.

Gamified Personal Finance

JoyCompass takes the intimidation factor out of personal finance by breaking it down into personalized, bite-sized, challenges.

The gamified system targets key areas for improvement, nudges users with tips, and rewards them at key milestones.

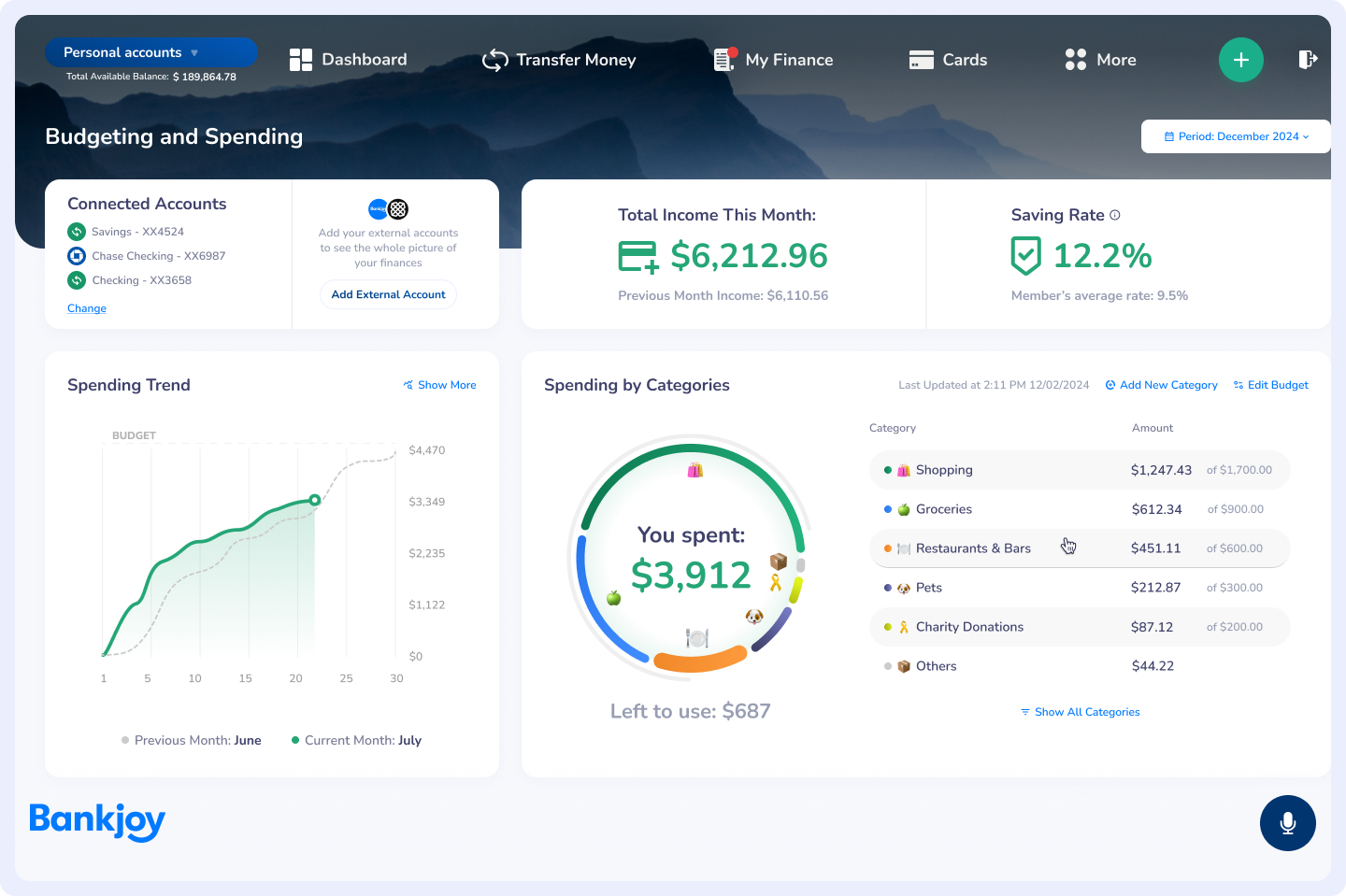

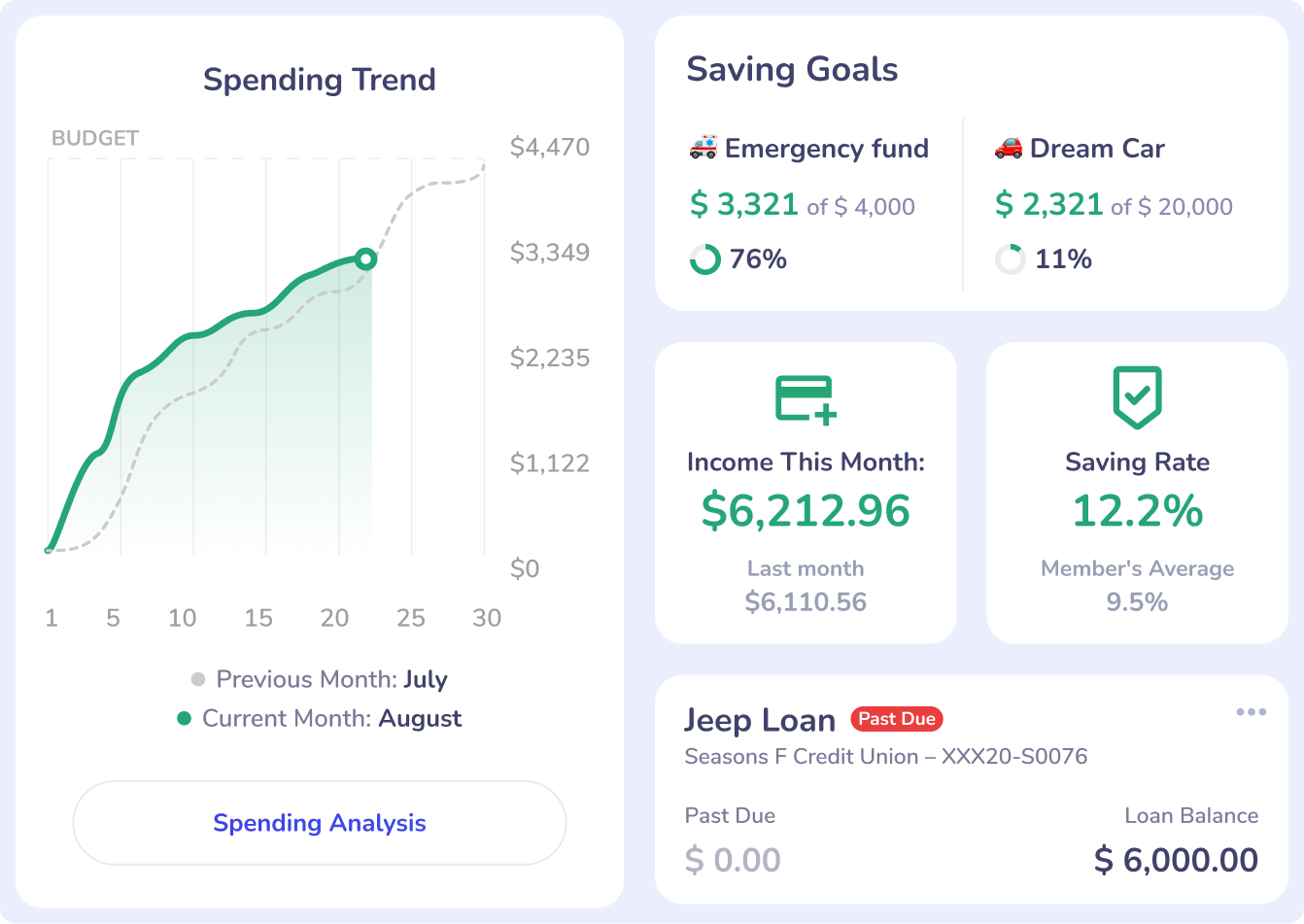

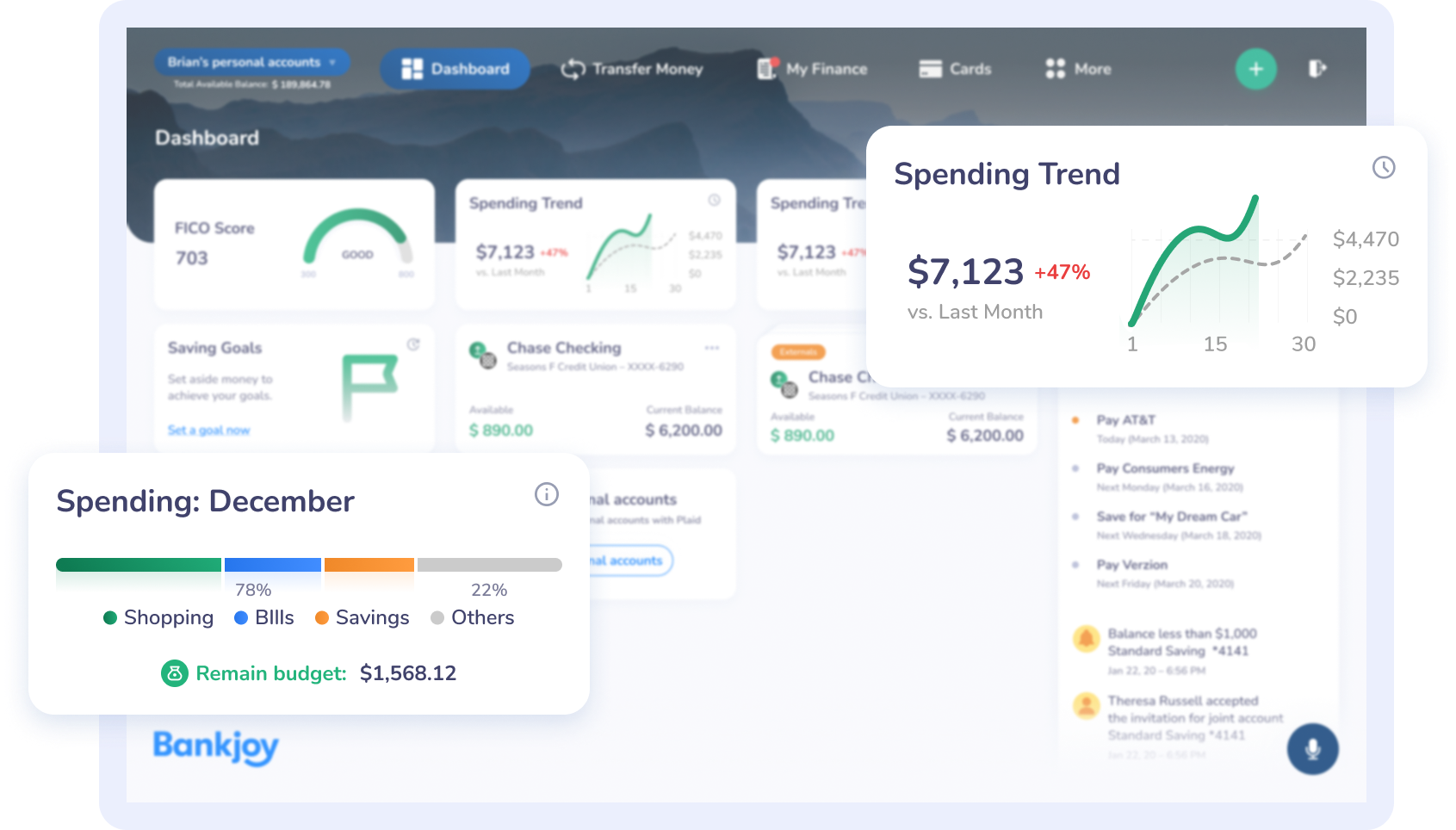

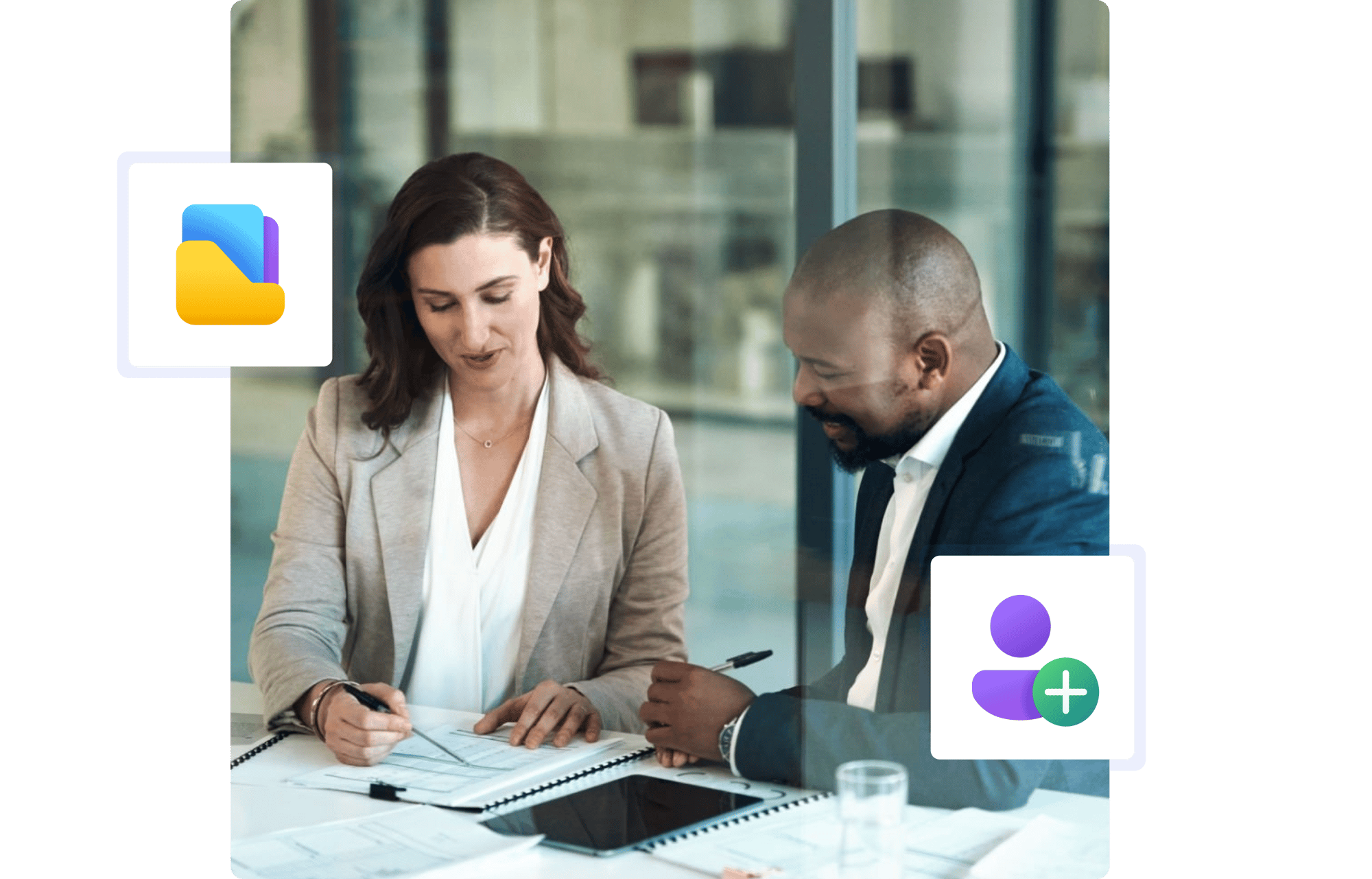

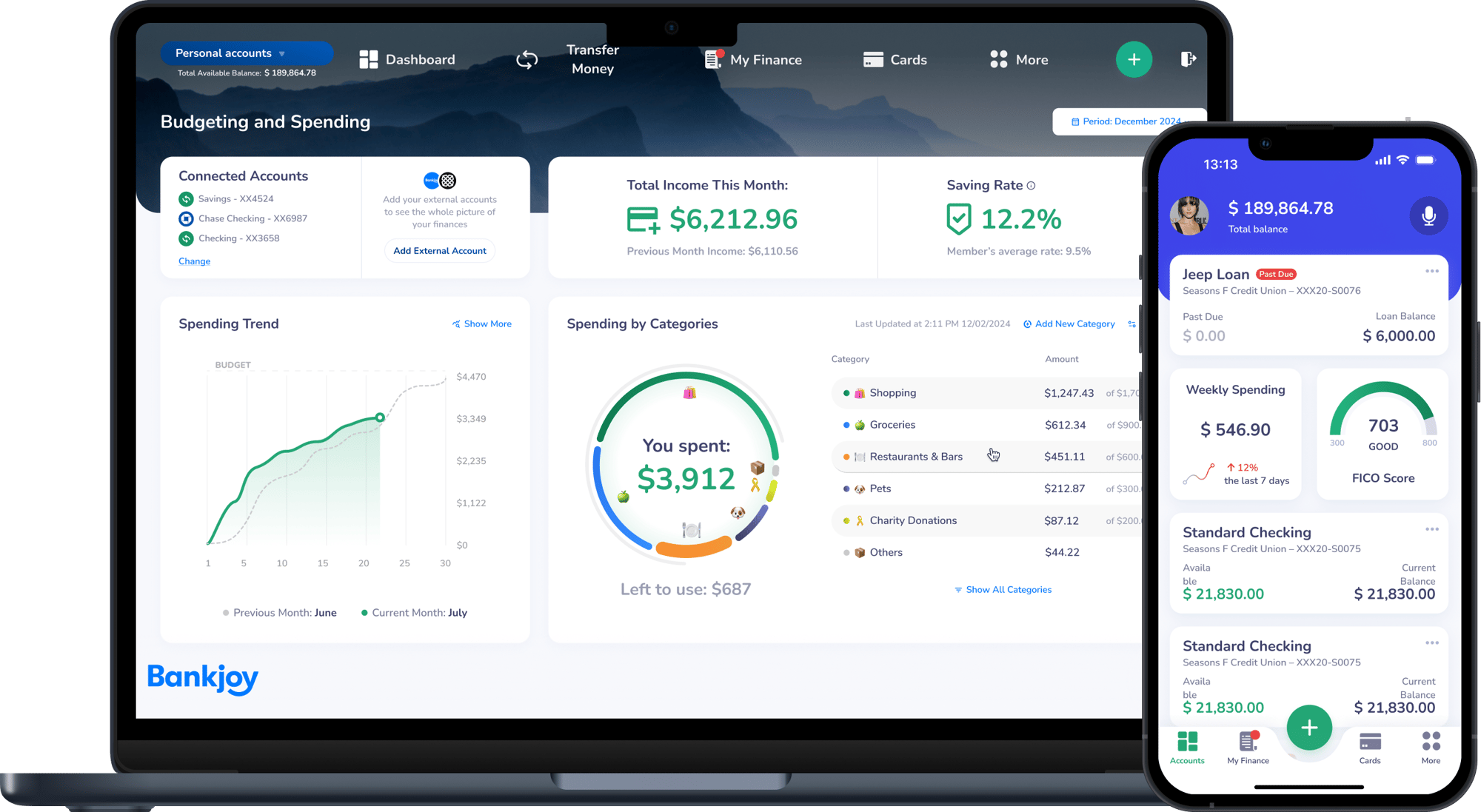

360° Financial Dashboard

Users can analyze their spending, monitor debt, watch their assets grow, and more—JoyCompass integrates with Plaid to automatically track and categorize financial activities across all your users’ accounts.

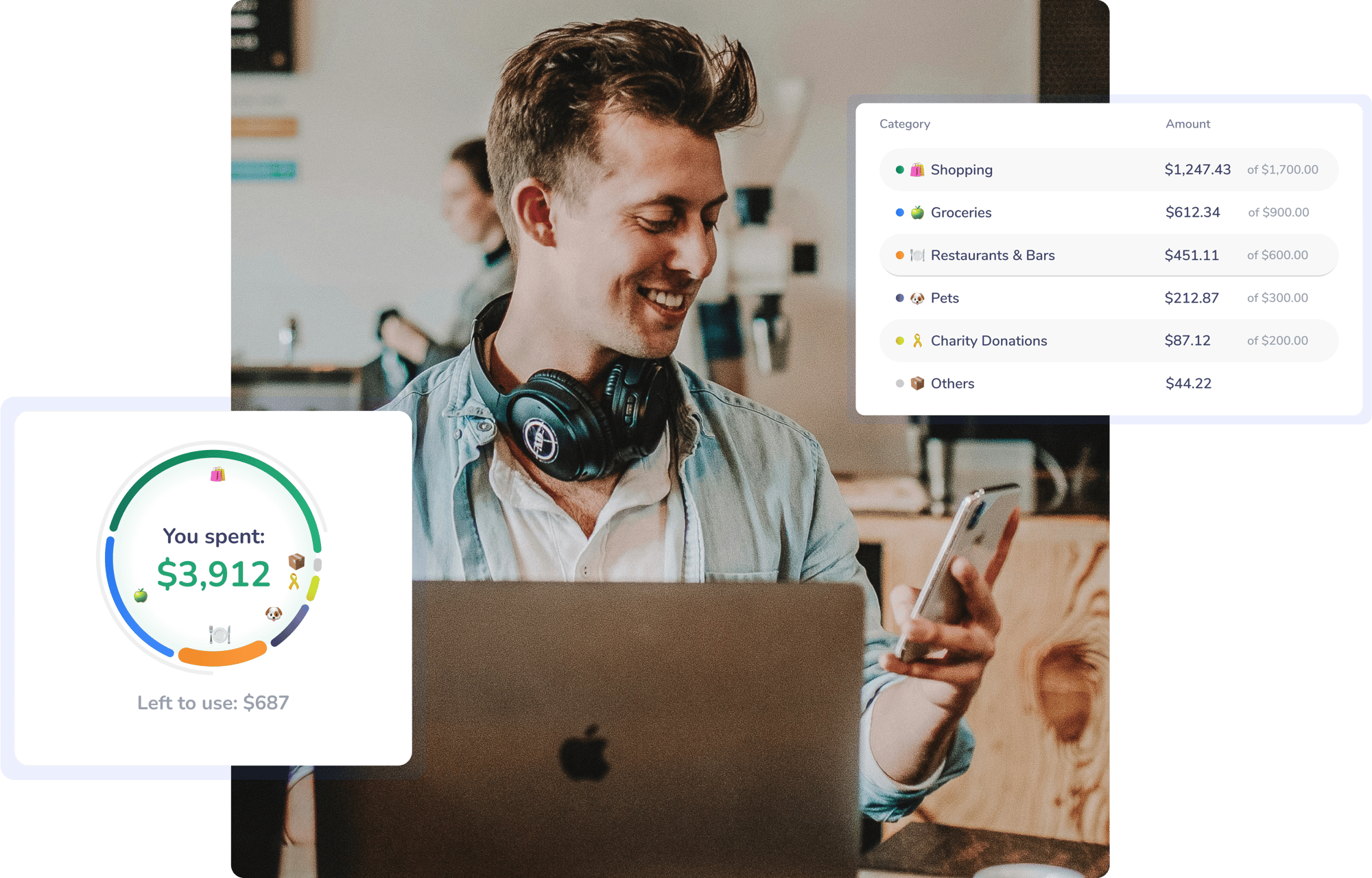

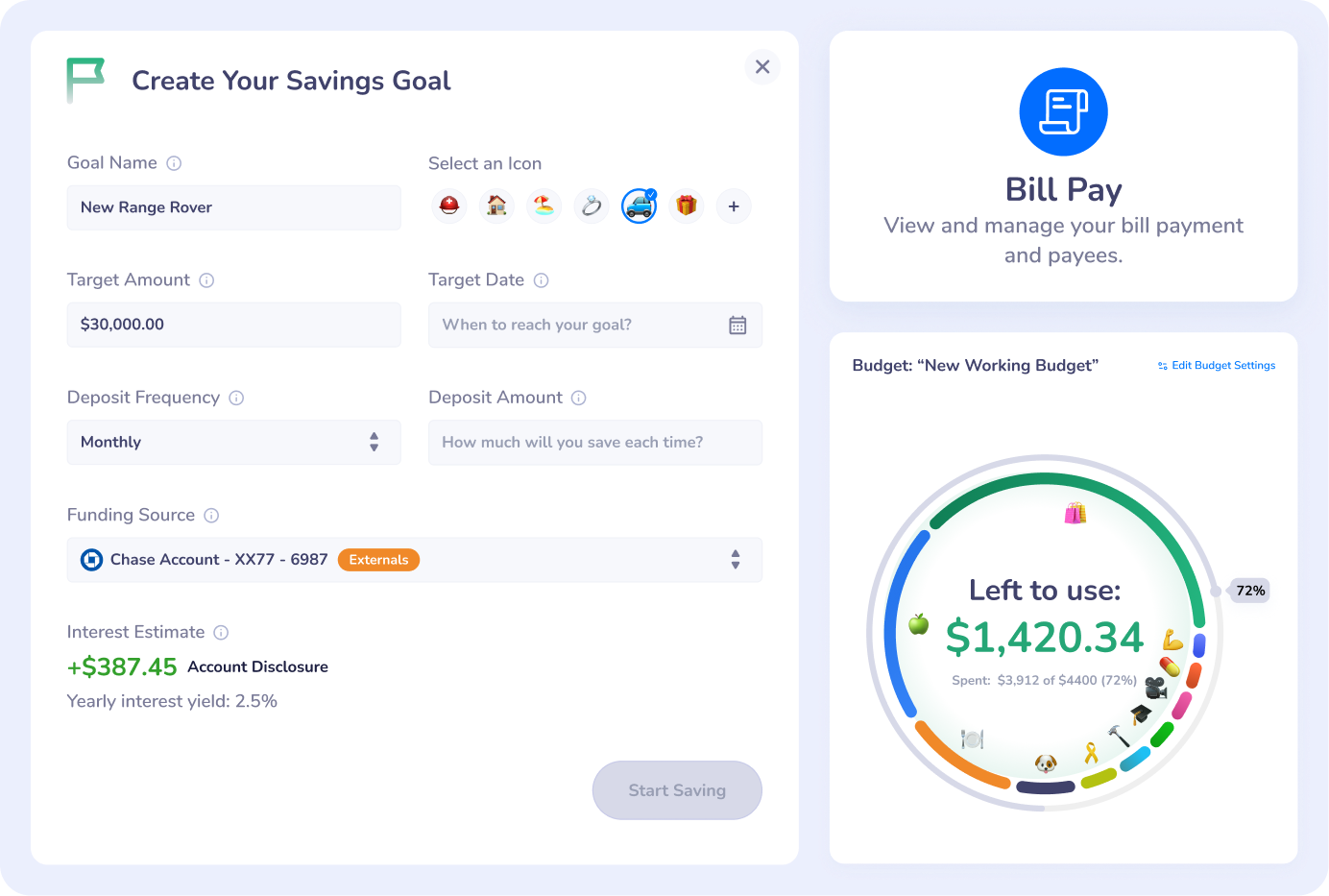

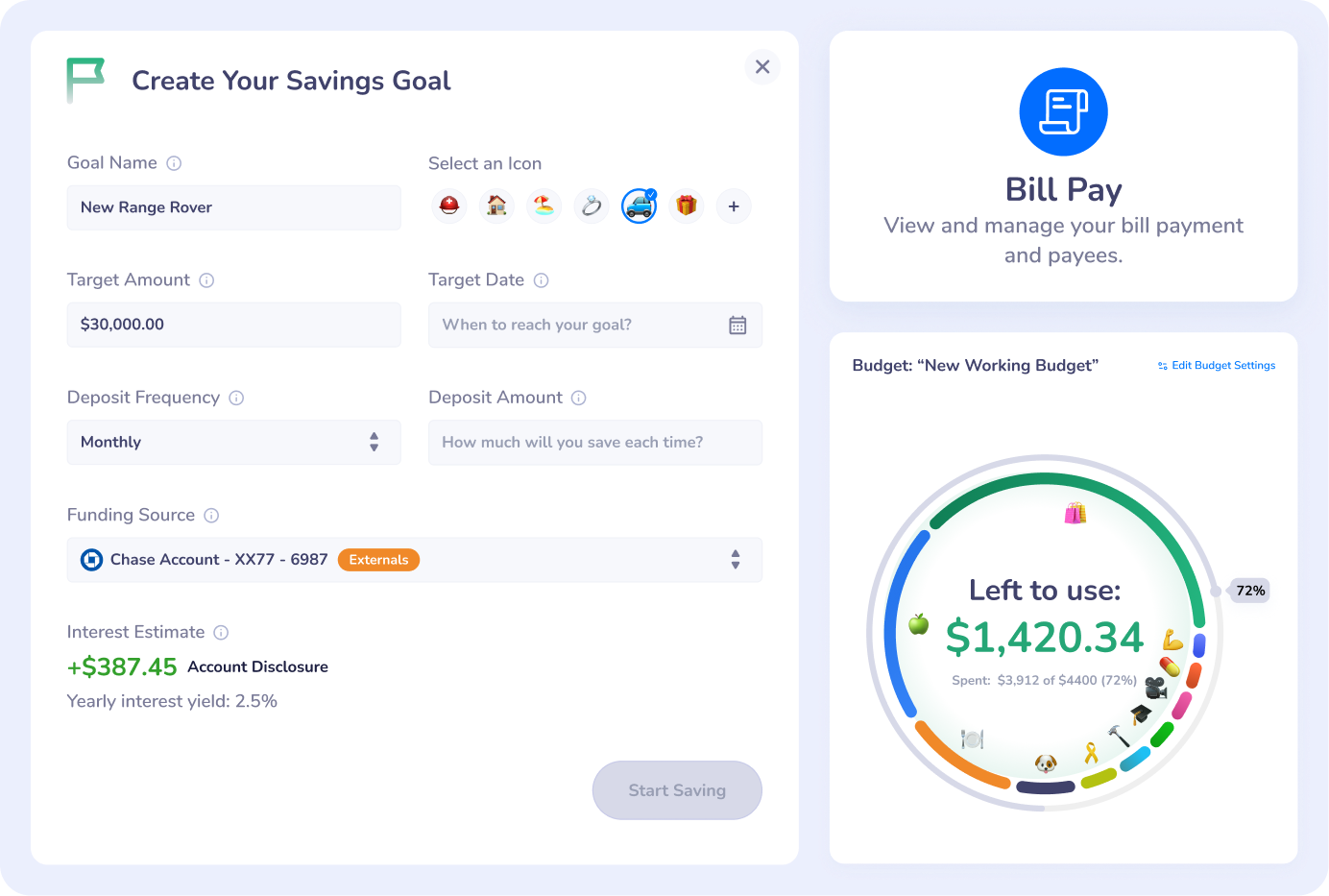

Advanced Personal Finance Tools

Dynamic budgeting. Goal setting. Subscription and bill management. Debt management. JoyCompass supports all this and more, giving users all the tools they need to master their personal finances.

Advanced Personal Finance Tools

Dynamic budgeting. Goal setting. Subscription and bill management. Debt management. JoyCompass supports all this and more, giving users all the tools they need to master their personal finances.

Financial Education

Put users on the path to financial literacy with personalized, approachable lessons and quizzes.

Social Connections

Your clients can invite others to collaborate on savings goals, share budgets, and take on joint challenges—turning your institution’s digital banking offering into a social ecosystem.

Social Connections

Your clients can invite others to collaborate on savings goals, share budgets, and take on joint challenges—turning your institution’s digital banking offering into a social ecosystem.

The Key to Growth: Financial Wellness Scoring

JoyCompass gives your clients a holistic picture of their financial situation and practical ways to improve it. As users embrace healthy financial habits, their score goes up—and you can reward them with badges, perks, better rates, and more.

This gives your institution a key advantage, too. Measuring and improving account holders’ financial health demonstrates your establishment’s commitment to a resilient community.

Unlock Growth Opportunities With 360° Personal Finance Data

JoyCompass is more than a personal finance app: it’s your key to increasing the lifetime value of your institution’s accounts.

As users take actions to increase their scores, JoyCompass securely tracks how users spend, save, budget, set goals. This gives you and your staff valuable insights, enabling you to build powerful, targeted marketing campaigns and grow revenue from accounts.

Goal Setting → Increased Deposits

Filter your accounts to people with ambitious savings goals, and send targeted messaging for deposit opportunities.

Income Streams → Direct Deposits

Pinpoint accounts receiving new income streams at external institutions and invite them to switch their direct deposits to yours.

Debt Payments → Loan Sales

Send refinancing opportunities to people paying down debts.

Easy-to-Use Marketing Tools

Turn insights into targeted marketing campaigns—no marketing background required. JoyCompass gives you the tools you need to serve the right messages to the right people at the right time.

Set-and-Forget Automation

Automatically send messages based on user actions.

Intuitive Targeting Tools

Narrow the audience of any campaign to the right people.

Performance Analytics

Track, measure, and report on campaign performance.

Email Marketing

Segment your audience, draft emails, and send messages.

SMS Messaging

Send text alerts, reminders, and promotions to specific audiences.

Push Notifications

Send messages directly to your account holders’ devices.

In-App Advertising

Display targeted messages directly in the user’s dashboard.

Dynamic Documents

Insert targeted messaging in statements and summaries.

The Latest Innovation From Bankjoy

As part of Bankjoy’s suite of digital banking technology offerings, JoyCompass works as a standalone offering as well as an augmented part of your Bankjoy digital banking platform.

Since 2015, we’ve helped banks and credit unions on their mission to bring financial health to their communities via technology that enhances people’s everyday lives. JoyCompass is our next step on our journey of helping financial institutions and the people they serve.

-

75+

Client Institutions

-

1m+

Accounts Served

-

120+

Integrations

-

4.8/5

User App Rating

Once-in-a-Lifetime Introductory Pricing

JoyCompass will be available to everyone later this year.

But until then, a limited number of pilot financial institutions will receive introductory pricing.

This pricing will only be available to community banks and credit unions who join the pre-launch pilot program. Sign up for early access below!

Why Bankjoy?

Bankjoy delivers modern banking technology and elegantly designed financial solutions, including feature-rich mobile banking, online banking, and a banking API to banks and credit unions. We prioritize creating world-class user experiences through advanced features, simple navigation, modern aesthetics, and direct user feedback, meeting the demands of today's consumers.